This article is Part 3 of a 3-part series on plastics compliance and sustainability for global supply chains. Read Part 1 for an overview of the current state of global plastic consumption, production, and sustainability efforts, or dive into the mandatory regulations governing global plastics supply chains in Part 2.

Introduction

The plastics industry stands at a pivotal crossroads. With sustainability regulations tightening and governments deploying both penalties and incentives, businesses must accelerate their shift toward circular, traceable plastics.

While taxes and levies target the production of virgin plastic and single-use plastics, tax breaks and incentives support companies that invest in sustainable alternatives, utilise recycled materials, or adopt circular business models. These fiscal policies aim to incorporate the environmental costs of plastic pollution into the price, encouraging more responsible production and consumption.

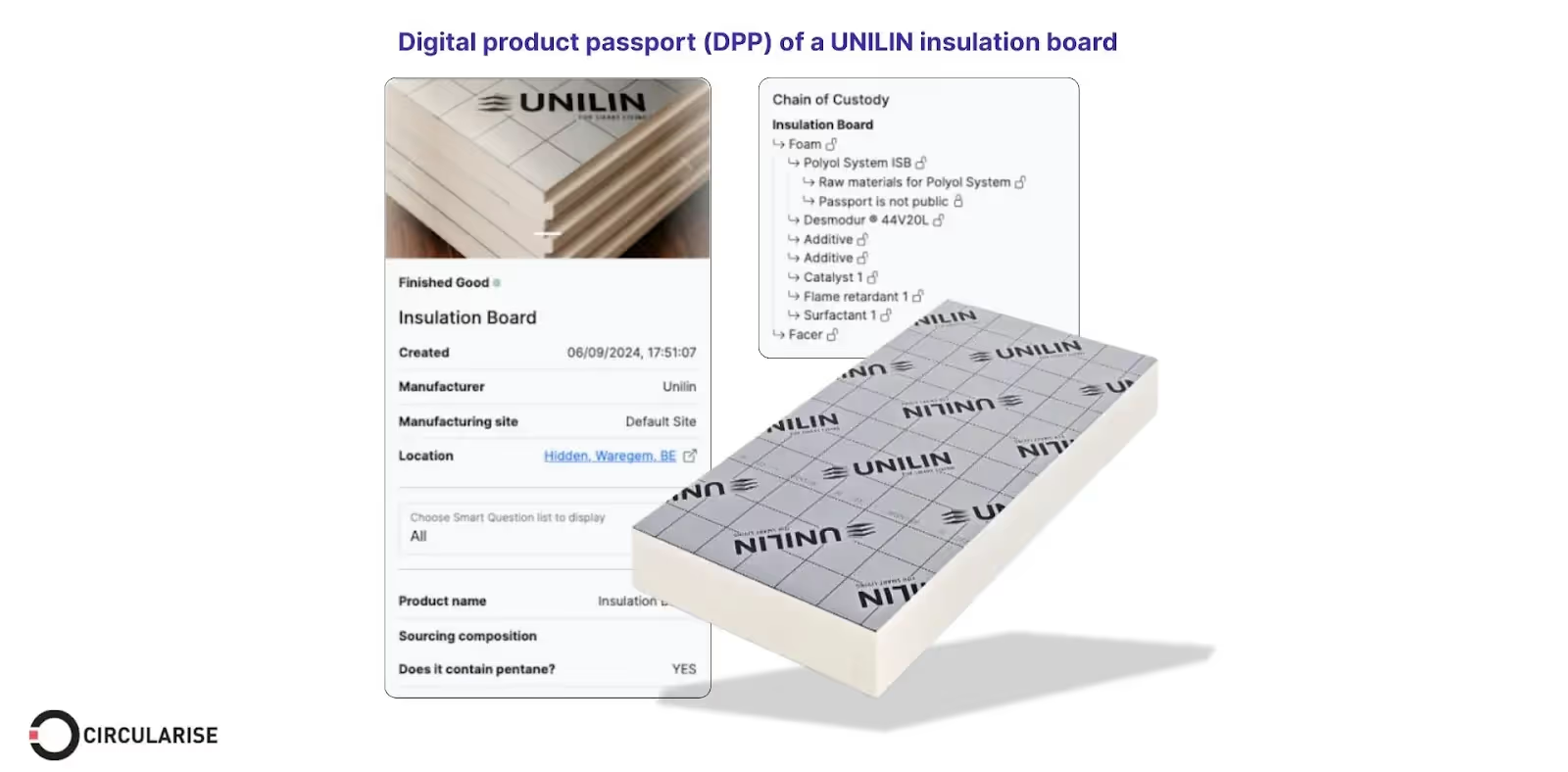

This article also examines how companies in the plastics industry can prepare for increasing sustainability regulations by leveraging material innovation and digital traceability to make circularity possible and verifiable. We break down the role of emerging technologies like pyrolysis, depolymerisation, and solvent dissolution, and explain how implementing mass balancing and digital product passports (DPPs) in your traceability systems can help you track and prove recycled content.

What is the EU Plastic Packing Levy and its impact?

Since 2021, the EU’s Plastic Packaging Levy has charged Member States €0.80 for every kilogram of non-recycled plastic packaging waste, encouraging countries and businesses to recycle more and reduce plastic waste.

While countries decide how to fund this levy, many impose direct taxes on businesses, increasing costs for companies that rely on plastic packaging. This encourages innovation in sustainable materials but may also lead to higher consumer prices.

Environmentally, the tax encourages recycling and reduces the use of virgin plastics. However, alternatives like bioplastics must be used carefully to avoid creating new environmental issues. The tax could also influence global trade by pressuring foreign manufacturers to adapt, while giving a competitive advantage to companies that invest in sustainable solutions. Looking ahead, the EU may extend the tax to cover more plastic products, which is likely to drive further investment in recycling systems and alternative packaging.

However, the European Union’s plastic taxation framework has also led to varied implementations across member states, with each country adopting different measures to address plastic waste. This fragmented approach adds regulatory complexity and creates administrative challenges for companies operating across borders.

- Bulgaria has introduced a new product fee for certain single-use plastic products under its Extended Producer Responsibility (EPR) system, requiring producers to file yearly reports, with the first submission due on 31 March 2024.

- Denmark increased the excise duty on carrier bags and disposable tableware in January 2024.

- Germany has implemented a national plastic tax on 1 January 2025 and has introduced an annual levy on single-use plastics, primarily for disposable food packaging, though the levy’s implementation has been postponed to 2026.

- Hungary implemented a new EPR system alongside the existing Environmental Product Charge (EPC) on 1 July 2023, applying to packaging and other plastic items, with fee rates based on product type and taxpayer profile.

- Italy has postponed its PPT implementation until 1 July 2026.

- Latvia has imposed a higher natural resources tax on foam polymer and polystyrene foam compared to other plastic raw materials.

- Lithuania has adjusted its pollution tax rates, exemptions, and other regulations, effective from 1 January 2025.

The Netherlands has revised waste management contributions for plastic packaging and expanded its EPR fee to include cigarette filters. - Poland introduced legislation in 2023 to impose fees on certain single-use plastics and established a deposit-refund scheme.

- Portugal expanded the scope of single-use packaging contributions, adjusted tax rates, and introduced new exemptions under the 2024 State Budget Law.

How the EU plastic tax drives sustainability in plastics

Nevertheless, it is clear that the EU’s plastic tax plays a vital role in supporting circular plastic supply chains by making non-recycled plastic more expensive. It is more than just a financial measure — it’s a strategic tool that aligns economic incentives with environmental goals to drive systemic change toward a sustainable plastic economy.

By increasing the cost of virgin plastic, the tax encourages change by:

- Incentivising companies to design products that are easier to recycle, incorporate more recycled content, and develop reusable packaging solutions.

- Prompting manufacturers to explore eco-friendly material innovations, such as biodegradable plastics, compostable alternatives, and high-quality recycled resins.

- Fostering investment in advanced recycling technologies like chemical recycling, which can turn hard-to-recycle plastics into reusable feedstock.

- Encouraging companies to prioritise closed-loop production systems, reduce reliance on fossil-based plastics, and minimise overall waste.

- Stimulating growth in recycling infrastructure by increasing demand for recycled materials. Higher costs for non-recycled plastic make investments in collection, sorting, and processing facilities more profitable, improving recycling efficiency and capacity across Europe.

- Driving shifts in consumer behaviour by making sustainable products more competitive. As businesses pass on costs, consumers are increasingly choosing recyclable or reusable alternatives, thereby reinforcing circularity at the end-user level.

Ultimately, taxation policies incentivise businesses to embrace sustainability, while traceability provides the transparency and accountability needed to meet these evolving requirements effectively. Alongside continuous material innovations, these forces are driving a future where plastics are both economically viable and environmentally responsible.

Nevertheless, it is clear that the EU’s plastic tax plays a crucial role in supporting circular plastic supply chains by making non-recycled plastic more expensive. By increasing the cost of virgin plastic, the tax encourages companies to design more sustainable products that are easier to recycle, integrate more recycled content, and develop reusable packaging solutions.

This financial pressure prompts manufacturers to explore eco-friendly material innovations, including biodegradable plastics, compostable alternatives, and high-quality recycled resins. It also fosters investment in advanced recycling technologies, such as chemical recycling, which can process hard-to-recycle plastics into reusable feedstock. Businesses are more likely to prioritise closed-loop production systems, reduce their reliance on fossil-based plastics, and minimise overall waste.

Beyond corporate innovation, the tax stimulates growth in recycling infrastructure by increasing demand for recycled materials. Higher costs for non-recycled plastic make it more profitable for companies to invest in collection, sorting, and processing facilities, improving the efficiency and capacity of recycling systems across Europe.

And finally, the tax encourages shifts in consumer behaviour by making sustainable products more competitive. As costs are passed on, consumers are increasingly opting for recyclable or reusable options, thereby reinforcing circularity at the end-user level.

More than just a financial measure, the EU plastic tax is a strategic tool that aligns economic incentives with environmental goals, driving systemic change toward a sustainable plastic economy.

Sustainable plastics: Material innovation and recycling technology

As governments introduce a mix of tax incentives and penalties to curb plastic use, businesses are adapting their supply chains to align with these measures. Across sectors, significant effort has been devoted to developing methods for remanufacturing and repurposing plastic waste, transforming it into a valuable resource that supports the circular economy and delivers long-term economic benefits.

As this field continues to evolve, numerous emerging technologies and plastic alternatives are being introduced to the market. Here are a few examples, out of thousands being tested today.

Bioplastics: A sustainable alternative

Bioplastics are derived from renewable resources, such as corn, sugarcane, and vegetable oils, and are processed into polymers that can serve as substitutes for conventional petroleum-based plastics. While bioplastics currently account for a small percentage of global plastic production, their growth is expected to continue. Due to their environmentally friendly nature, they represent a revolutionary solution in the plastics industry, particularly in regards to packaging — in 2022, 48% of global bioplastic production, about 1.07 million tonnes, was used in packaging.

However, scalability remains an issue, as it would require an increase of more than half of the current corn production in Europe, as well as an increase of over 60% in annual freshwater withdrawal.

Advanced recycling technologies in plastics

Advanced recycling in the plastics industry refers to a set of technologies that break down plastic into its basic raw materials, allowing it to be remanufactured back into new plastic products. This prevents plastic from ending up in landfills and incinerators, or polluting the environment, while keeping it within the economy. Chemical recycling often employs the mass balance approach to work efficiently and comply with regulations.

Despite some misconceptions, advanced recycling technologies do not involve incinerating or burning plastic, as burning would yield no marketable products. Essentially, advanced recycling allows plastic to be reused and remanufactured repeatedly. These technologies could significantly expand the variety and volume of plastic we can recycle, such as recycling composite materials often used in green energy solutions.

This will also reduce reliance on virgin resources and lower greenhouse gas emissions. Studies have shown that the air emissions from advanced recycling facilities are similar to those from universities, hospitals, and light manufacturing operations.

Pyrolysis

Pyrolysis uses heat to break down plastic waste into raw materials that can be processed alongside fossil-based feedstocks. ExxonMobil integrates this process into its facilities, using ISCC PLUS methodologies to track mass balanced and recycled content.

Depolymerisation

This method breaks plastic into monomers, which are purified and reused to make high-quality new plastics. Companies like BASF, Trinseo, and Carbios are investing in this technology to enhance circularity.

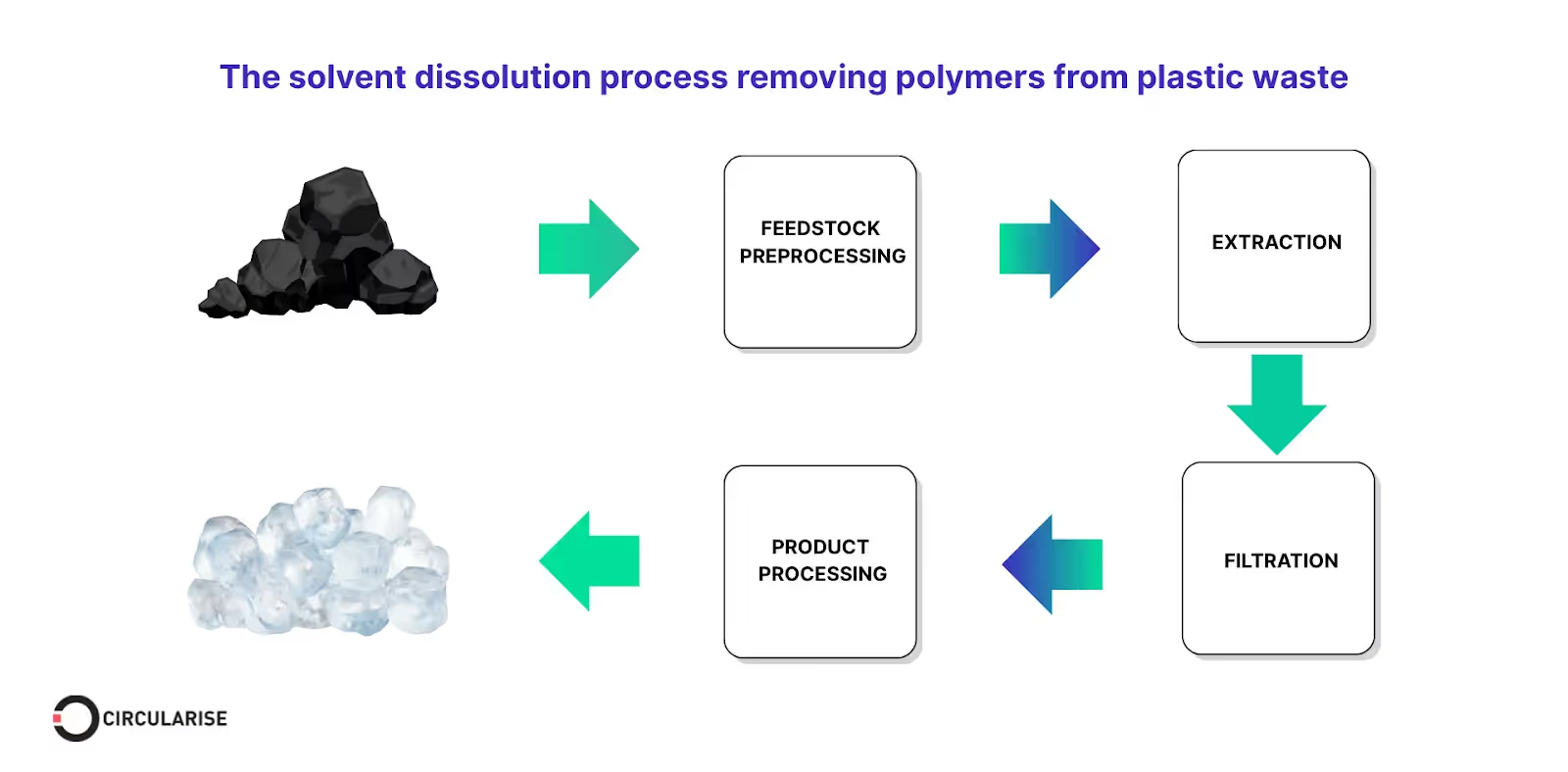

Solvent dissolution

Solvent dissolution selectively removes polymers from plastic waste, separating contaminants and preserving material quality. Dow, P&G, and PureCycle use this method to recycle plastics that are difficult to recycle, such as polyethene (PE) and polypropylene (PP).

Circularise is the leading software platform that provides end-to-end traceability for complex industrial supply chains. We offer two traceability solutions: MassBalancer to automate mass balance bookkeeping and Digital Product Passports for end-to-end batch traceability.

Get in touch with our team to explore how your company can understand your supply chain better

.png)